Why My Father Was Ashamed of Me

I’m now known as “the farmer’s lawyer,” but that hasn’t always been the case. Once upon a time, I worked as a corporate lawyer for a big bank and a Fortune 500 company.

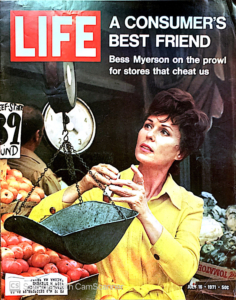

My first job after graduating from New York University School of Law in 1970, however, was with the New York City Department of Consumer Affairs. This was the first consumer protection agency in the United States and I joined it soon after it started. I worked under former Miss America, Bess Myerson, who was a pioneering consumer advocate. In 1971, Commissioner Myerson (we all called her Bess) was on the cover of Life Magazine as “A Consumer’s Best Friend.”

I was one of the young lawyers and investigators she hired and it was a wonderful, fun job.

During my time at the NYC Department of Consumer Affairs, I learned about an incredible array of deceptive and unconscionable practices used to cheat consumers and borrowers.

The worst of these was something called “sewer service”.

Myerson’s staff; I am on the far right

It came about when major New York businesses (department stores, banks, utilities) hired law firms who specialized in debt collection or collection agencies affiliated with law firms, to “serve” (deliver) the paperwork that started the collection case (the summons and complaint) on the debtor. But, some of these firms’ agents and employees didn’t want to go into neighborhoods that weren’t “safe” – in other words, poor minority neighborhoods. Instead of serving the complaints, they simply filed false affidavits of service. The law firms then acted on these false affidavits by entering default judgments for the amount claimed in the complaint, adding in costs, expenses, and a 25% bump for so-called attorneys’ fees (even though no attorney’s time was involved). The first time the unfortunate debtors would even learn that they had been sued was when a garnishment of their wages was made based on a default judgment in an amount that was greatly in excess of the original debt because it now included penalties, extra interest, and perhaps an extra 20 or 25% for fake attorney’s fees.

The Department of Consumer Affairs gathered thousands of affidavits of service and showed that some of these dishonest process servers claimed to have in Brooklyn, the Bronx and Queens on the same day in the same hour! It was a scandal and the creditors who had used these crooks for debt collection got a lot of bad press.

You might be curious about how the name “sewer service” came about. We started to call it “sewer service” when a New York City sewer was found to be clogged with a bag of unserved summons and complaints.

Shortly after the “sewer service” scandal hit, I found a job in the legal department of Manufacturers Hanover Trust Company, then the second- or third-largest bank in Manhattan. The bank hired me to proactively review its own practices and the practices of its contractors (including collection agencies) that could possibly create the same kind of bad publicity that befell lenders caught in the sewer service scandal. I loved this job: to protect the bank’s reputation and prestige by making sure it was following the letter and spirit of the law and adhering to proper standards of ethical behavior. While I was there, we fired a lot of debt collection agencies, translated documents into Spanish for use in Spanish speaking areas, and put contracts into plain English. And, almost all of the time, the bank took my advice.

MHTCo stands out in my memory as a good corporate citizen; it has since been swallowed up in a merger.

Though it seemed improbable that someone from North Dakota (which had a population of 626,000 in 1967 when I left for law school) — would love living in a city of 15,602,000 people – I did. It was fun, and full of adventures. But the city didn’t have everything. One night when I looked up at the night sky from the Upper West Side, I realized I hadn’t seen stars in years.

New York City was much grittier and grimier then than it is today. Even though I worked in a fancy office on Park Avenue, I was living in a cockroach-infested apartment on the Upper West Side. To get home from my job at MHTCo, at 35th and Park, I had to take three hot crowded subways. At the 112th and Broadway exit, I tightly gathered my possessions in my arms and took off running as fast as I could for two long dangerous blocks. These aerobic sprints were my daily exercise and an accepted part of life in the city.

So when I received a call out of the blue from a headhunter on behalf of the legal department of a Fortune 500 company with headquarters in Connecticut, I agreed to take the train and check it out. Though the company’s name was not well known, its products were in grocery stores, drug stores and department stores all over the country.

The headquarters of the company was in a leafy, bucolic, and very wealthy suburb of New York City. It was in a new three-story building with large windows overlooking the countryside on one side and a charming downtown shopping area on the other side. It had a beautiful Japanese garden on the roof top with graveled walks and well-situated benches that conveyed peace, calm, and restraint. I’d been recruited with the lure of high pay, but when I found a sweet little cottage behind a bower of roses for less rent than we paid in New York City, and saw the beautiful city beaches, I decided to accept the offer. Only later would I learn that the doors to the Japanese garden were locked, the cottage was a converted garage, and the city beaches were deemed tawdry and most residents went to private, members-only beaches of the many yachting clubs.

My father—who, as a matter of principle, had never accepted any legal work from a corporation—was appalled when I told him about my new job. He felt this was even worse than working for a bank. At the time, he was on the North Dakota Supreme Court, and I was only a few years out of law school but I was earning more than he did.

When I went back to North Dakota for a visit, he couldn’t brag about my work. Instead, he glumly introduced me to acquaintances as, “This is my daughter Sally; she earns more than me.”

I spent the next year and a half unwittingly flouting most if not all of the expected standards of conduct for a corporate counsel of that company. How was I to know my job in essence was to hide wrongdoing, to facilitate misleading advertising, to cater to the business needs of the company and not the value to the consumer? I motored along as I had at the Department of Consumer Affairs and at MHTCo, but it was soon obvious that no one liked me or my work. I didn’t understand why this was so! For example, I saved a marketing manager from false advertising. I asked him for proof of a positive claim on a new product (“Please bring me scientific studies that verify this claim”). But all he brought me was a market research report that said that if the claim wasn’t made, consumers not buy it so I did not approve the label.

When a young lawyer from the company’s DC law firm showed up unannounced on a day when the other lawyers happened to be away, he gave me a subpoena from the Federal Trade Commission that demanded production of all advertisements for a certain product. I left him in the reception area and I hustled all over the building to find every advertisement that I could dig up, and delivered them to the lawyer. He seemed shocked. He knew something I did not: there was a decades old settlement agreement with the FTC that said my employer would not make the claims that were in many of these ads.

I later deduced that when they found out what I’d done, the marketing team for this product was furious. I had screwed up! Apparently, I wasn’t supposed to make a thorough search.

That’s how I first learned about the “in-house” and “out-house” lawyer scam. The out-house lawyer (the lawyer from an outside law firm) asks the in-house lawyer to search for information responsive to a request from a government agency or from an attorney on the opposing side in a lawsuit. The in-house lawyer is supposed to wander around, and eventually find a few innocuous documents to be passed to the out-house lawyer. The out-house lawyer can then tell a court or adversary with a straight face: “I conducted an appropriate search with the proper people at my client’s office and this is all that I found.”

Not too much later, the General Counsel called me into his office. “How do you like it here?” he asked.

Because I had by then realized I was a misfit, I was honest. “I am not happy,” I said. “I don’t like it here.”

I didn’t tell him why I felt like such a misfit.

And my boss didn’t tell me that marketing managers from all over the company were demanding that I be fired before I could do more damage to the company, to the sale of their products and the company’s quarterly bottom line. (I didn’t know about this behind-the-scenes drama until years later, when another former employee filled me in.)

When I said I didn’t like it there, my boss (a nice guy) visibly relaxed. “I’m so glad. I’ll do my best to find you another job where you are a better fit. I’ll give you a great reference.” He was true to his word. On February 20, 1976, I accepted an offer to work at the Federal Trade Commission in Washington, D.C. as head of the new Equal Credit Opportunity enforcement program. I was 29 years old.

I don’t regret my brief career of being a bank and corporate lawyer. I learned a lot about how big corporations operate and this knowledge proved to be valuable in my work with farmers when I moved back to North Dakota. I learned about the power of consumer protection laws and that bad corporate behavior can be changed, when it is exposed to the light of day as Bess Myerson and her team had done with sewer service and many other scams. Farmers – isolated and alone on their farmsteads – sell to and buy from huge national and multinational corporations, and in too many cases farmers are victims of sharp practices of those corporations.